The Current Taxes page lists the currently configured individual tax rates you have in place for collecting tax payments. It also lets you edit the current taxes, configure new taxes, and delete taxes. By configuring the current taxes, you are setting the global system taxes that are applied to all products by default. When adding a tax, you have the option to set the country, state or province, and zip codes for which the tax will be collected.

The advantage of investing in the effort of configuring these taxes is that you will not have to manually calculate taxes to apply to orders and quotes. Any online orders will automatically have taxes applied, thus saving time and reducing errors which increases your overall efficiency and productivity.

In this article, you will learn how...

Prerequisites

- You must have administrator access to use this feature

To configure a new/current tax:

- Log into your DecoNetwork Website.

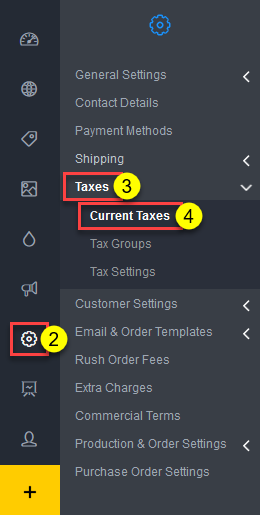

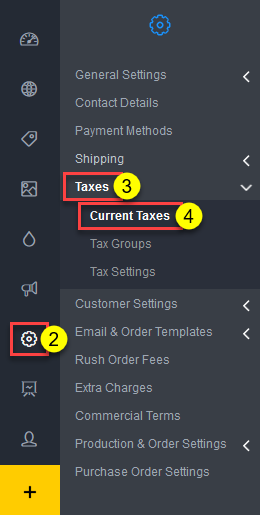

- Browse to Admin > Settings > Taxes.

Select Current Taxes.

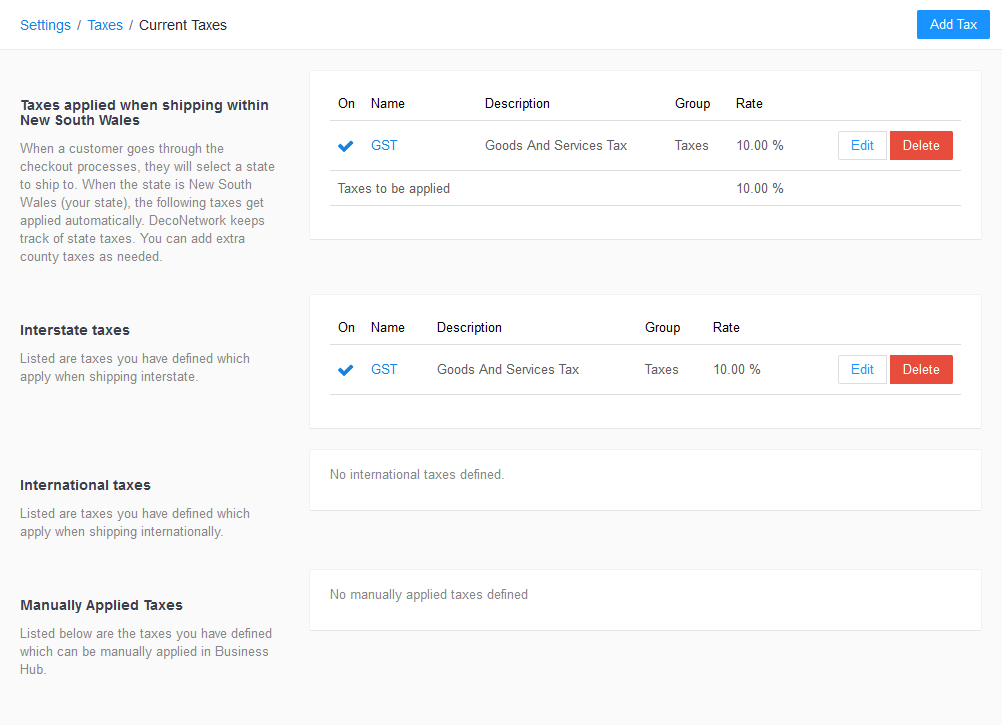

The main work area lists your presently configured taxes, which may be edited or deleted using the Edit and Delete buttons respectively. Taxes are organized into sections. The top section shows taxes within your state, followed by Interstate, International, and Manually Applied Taxes. An Add Tax button in the top bar lets you configure a new tax.

- Click Edit beside the tax you want to edit or click Add Tax to configure a new tax.

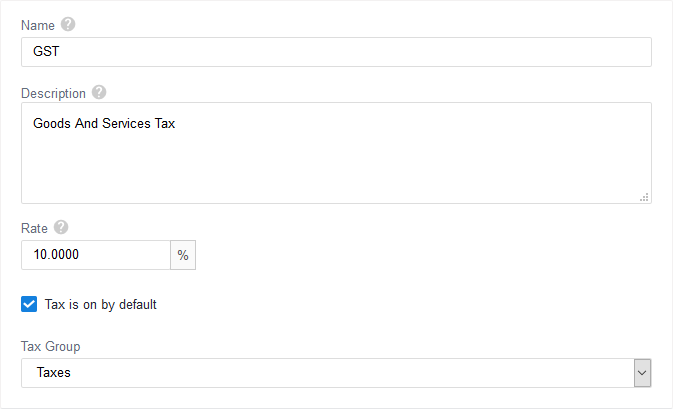

Each new or existing tax shares a common configuration screen:

Tax rulesThis section lets you choose how taxes are applied

- This tax has to be manually applied through Business Hub

- This tax is automatically applied based on location rules when creating an order or quote.

- Name: enter a name for the tax.

- Description: enter a description for the tax.

- Rate: enter the tax percentage rate.

- Tax is on by default: this checkbox allows you to enable/disable the tax. Initially, it will be ticked.

- Tax Group: assign the tax to a tax group. Tax groups allow you to easily apply/remove a tax collectively from a quote or order. Click here for instructions on how to configure tax groups.

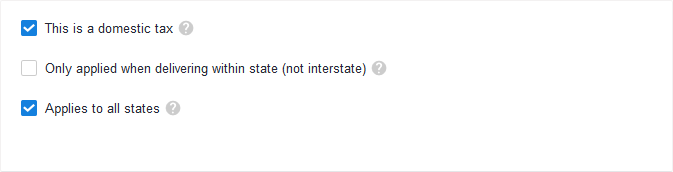

These settings allow you to set to what destination the tax applies.

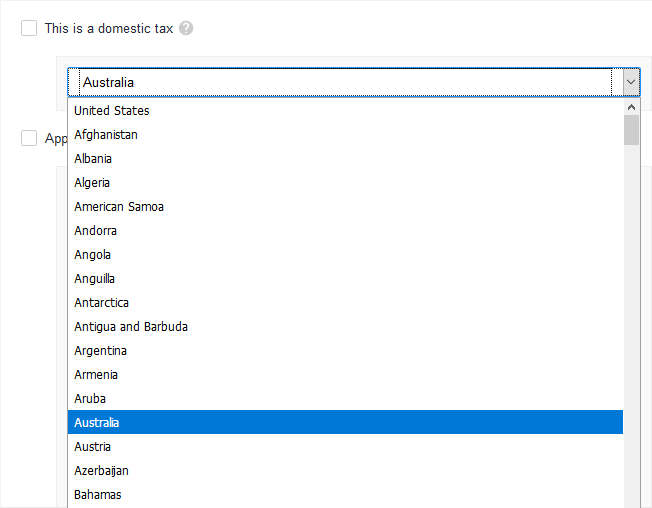

- This is a domestic tax: leave this checkbox ticked to apply the tax within your company's country of operation. Otherwise, un-tick it to reveal a drop-down box, allowing you to select a country to which the tax will apply.

- Only applied when delivering within state (not interstate): if "This is a domestic tax" is ticked, you also have the option of only applying the tax within your state.

- Applies to all states: If this checkbox is ticked, the tax will be applied to all states within the country indicated by the first checkbox/country drop-down box. If un-ticked, you will be able to set the states to which the tax will apply below.

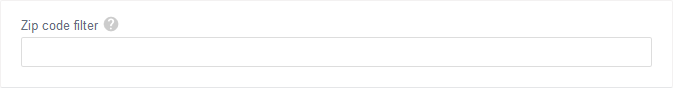

- Zip code filter: lets you specify a range of zip codes of the locations for which the tax will be applied.

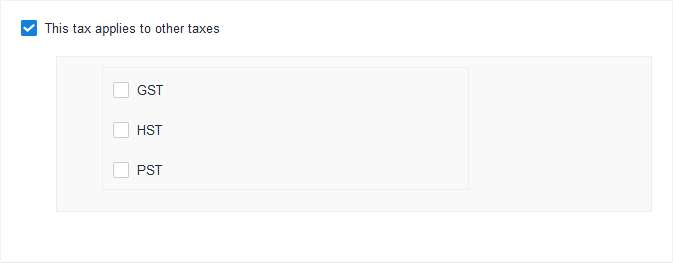

- This tax applies to other taxes: lets you select the taxes to which this tax will be applied.

- When done configuring, click Save.

To delete a current tax:

- Log into your DecoNetwork Website.

- Browse to Admin > Settings > Taxes.

Select Current Taxes.

The main work area lists your presently configured taxes.

- Click Delete beside the tax you wish to remove.

- Click OK to confirm you really want to delete the tax.

Comments

1 comment

How do you create a report so you can figure out how much taxes you owe? Please don't say "export it to excel and figure it out."

Please sign in to leave a comment.