You can set product taxes at three levels - at the global level (system defaults), at the product group level (product groups), and at the individual product level. All products will initially have system tax settings automatically applied. Product Groups represent groups of product types. Each product is assigned to a product group, which initially adopts the system default tax settings. By configuring product groups you can override the system default taxes for groups of objects in bulk. You can also override the default taxes for individual products.

In this article, you will learn how...

To learn about setting taxes at the global level, click here. To learn more about product groups, click here.

Prerequisites

- You must have administrator access to use this feature

To set individual product taxes:

- Log into your DecoNetwork Website.

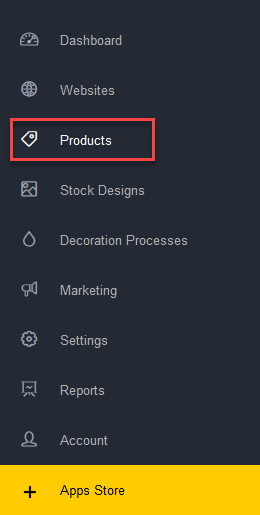

- Browse to Admin > Products.

- Select a product to configure by either:

- Clicking on the product code.

- Clicking on the product name.

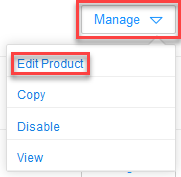

- Clicking on the Manage button beside the product you want to configure, then selecting Edit Product.

The product properties will be shown in the main work area, with a menu at the left to select property categories. General will be selected by default.

- Select Taxes from the product properties menu.

The main work area contains the Tax Settings configuration options for the product.

- Configure the settings as required.

- Tax exempt: tick this checkbox if you do not wish tax to apply to this product when sold in your stores.

- Use System: select this option if you want this product to use all system taxes as configured under Admin > Settings > Taxes > Current Taxes or configured for the assigned product group (if custom settings are specified).

- Specify Custom: select this option if you want to override the default tax rates:

- On: untick this checkbox if you do not wish the tax to apply to this product.

- Use Default Rate: untick this checkbox to specify a different rate from the default.

- Click Save or Save and Continue when done.

To set product group taxes:

- Log into your DecoNetwork Website.

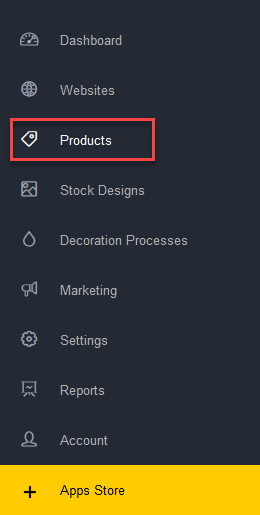

- Browse to Admin > Products.

- Select Product Groups.

The main work area contains a list of existing Product Groups.

- Click Edit beside the product group you want to configure taxes for.

-

Select Taxes from the product group properties menu.

The main work area contains the Tax Settings configuration options for the product group. (These are the same as the settings at the individual product level).

- Configure the settings as required.

- Tax exempt: tick this checkbox if you do not wish tax to apply to products belonging to this tax group when sold in your stores.

- Use System: select this option if you want this product to use all system taxes as configured under Admin > Settings > Taxes > Current Taxes or configured for the assigned product group (if custom settings are specified).

- Specify Custom: select this option if you want to override the default tax rates:

- On: untick this checkbox if you do not wish the tax to apply to this product.

- Use Default Rate: untick this checkbox to specify a different rate from the default. The rate value will be editable when the checkbox is unticked.

- Click Save or Save and Continue when done.

Comments

0 comments

Please sign in to leave a comment.